mass tax connect make estimated payment

You may pay with your. Keep an eye out on our ever-changing frequently updated FAQ page on massgovdor.

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

With a MassTaxConnect account you can.

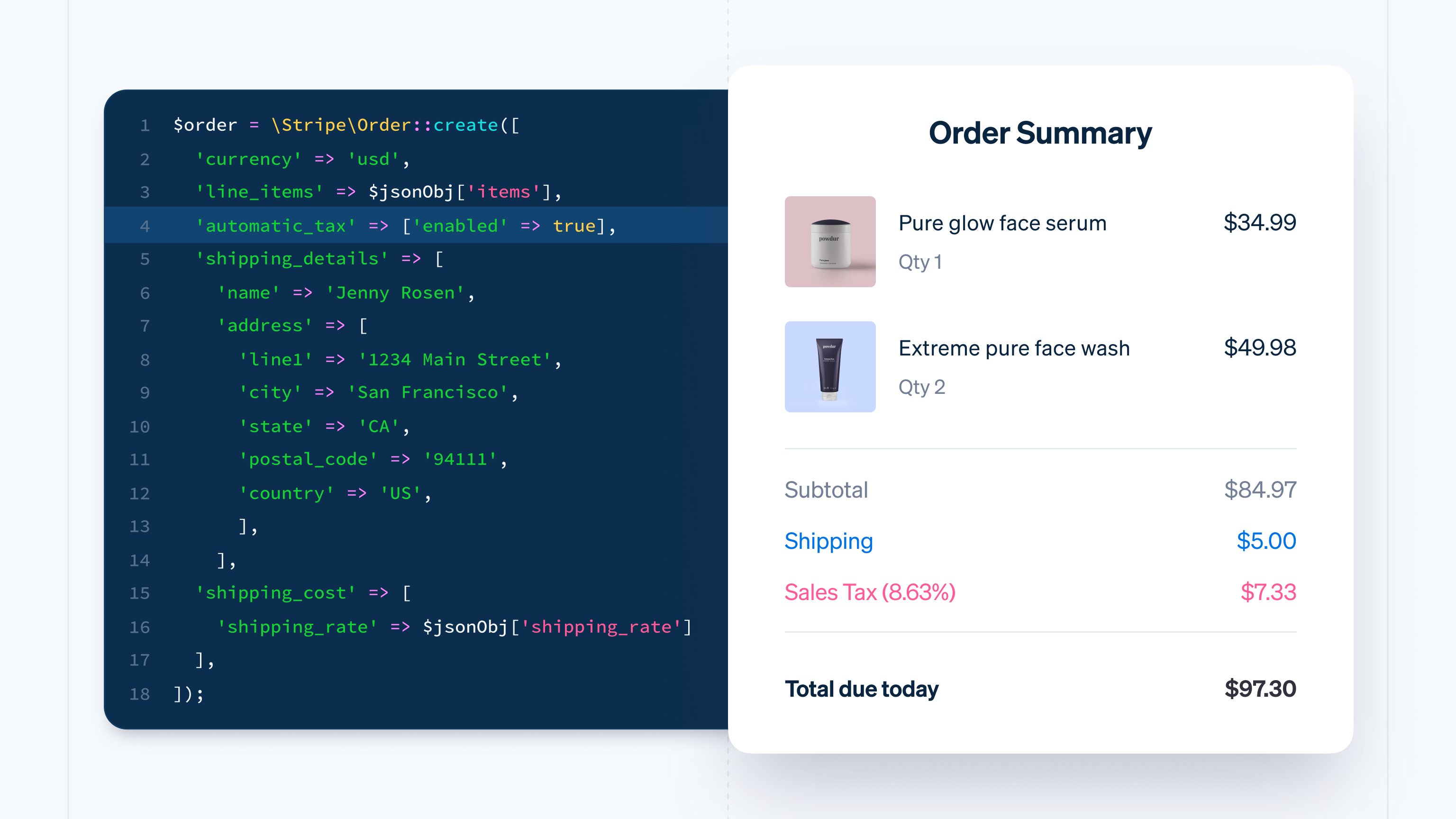

. Here S How Our Media Platform Preferences Fluctuate Throughout The Day Marketing Charts Tv Connect Infographic Marketing Marketing. You can use your credit card or Electronic Fund Transfer ACH Debit from either your checking or saving account. Individuals and Fiduciaries can make estimated tax payments online through MassTaxConnect.

Enter the ID and your phone number. Open link httpsmtcdorstatemausmtc_ From this page click on the Make a Payment tab then youll be prompted to log in to your account. You can make your personal income tax payments without logging in.

Understanding The Connections Food Insecurity And Obesity Understanding Food. Paying online through MassTaxConnect allows you to. Schedule for estimated tax payments All corporations that reasonably estimate their corporate excise to be in excess of 1000 for the taxable year are required to make estimated tax payments to Massachusetts.

From the MassTaxConnect homepage select the Make a Payment hyperlink in the Quick Links section. Make estimated payments and immediately confirm that DOR has received your payment. You can make your personal income tax payments without logging in.

Select individual for making personal income tax payments or quarterly estimated income tax payments. You do no need an account. Visa MasterCard or Discover credit card or Visa or MasterCard debit card.

With a few clicks find out your refund status. Estimated taxes must either be. Have 247 access to view your payment history.

Organizing your financial records and setting payment reminders can help you stay on top of your estimated tax obligations for years to come. Choose the appropriate ID Type. The new filing system will replace webfile for business.

For some workers tax season doesnt end on April 19. Mass tax connect make estimated payment. Form 1 Resident Income Tax Return Form 1-NRPY Nonresident or Part-Year Resident Income Tax Return.

Make estimated tax payments online with masstaxconnect in addition extension return and bill payments can also be made. Individuals with a masstaxconnect login can also make payments by logging in. Access account information 24 hours a day 7 days a week Submit and amend most tax returns Make bill payments return payments estimated tax payments and extension payments from a bank account or using a credit card Change or cancel payments previously scheduled through MassTaxConnect Set up payment.

Making Estimated Income Tax Payments Taxpayers filing the following Massachusetts income tax forms should use Massachusetts Form 1-ES to make estimated tax payments or may pay electronically online at wwwmassgovmasstaxconnect. Department of Revenue recommends using MassTaxConnect to make tax payment online. For some of us its still TaxSeason If you are looking for your tax refund use our online refund tracker on MassTaxConnect available for you 247.

There is a convenience fee of 235 of your payment amount charged by the third party that provides this service. MassTaxConnect makes it easy convenient and secure for you to make payments. Click the Continue button Print the receipt for your records.

Enter the taxpayers name. If you want to learn more about estimated tax payments in Massachusetts visit the DOR website or call DORs customer service call center at 617 887-6367 or toll-free in Massachusetts at 800 392-6089. MassTaxConnect gives you the option to pay by EFT debit.

Bill Payment Estimated Payment Return Payment. Use this link to log into Mass Department of Revenues site. Prepare And E File Your 2021 2022 Ma Income Tax Return.

Posted on Feb 19. ONLINE MASS DOR TAX PAYMENT PROCESS. Select the Individual payment type radio button.

Select the Payment Type option. Paid in full on or before the 15th day of the third month of the corporations taxable year or. Complete the information on the next page personal information bank information payment amounts and due dates.

Schedule payments in advance and cancel or change scheduled. What Are Estimated Taxes and Who Must Pay Them. Note that there is a fee for credit card payments.

Saturday February 12 2022. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Under Quick Links select Make a payment in yellow below.

Freelancers contractors and any professional who doesnt have taxes withheld from paychecks may be required to make an estimated tax payment at the end of each quarter in Massachusetts.

Irs Offers Estimated Tax Relief For Farmers And Fishermen Kiplinger

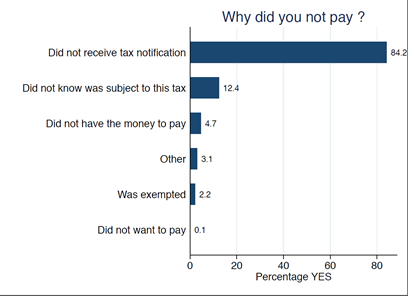

Strengthening Property Valuation For Taxation In Dakar Senegal Ictd

Tax Guide For Pass Through Entities Mass Gov

Prepare And E File Your 2021 2022 Ma Income Tax Return

What Happens If You Miss The Income Tax Deadline Forbes Advisor

The Eu In 2021 General Report On The Activities Of The European Union

Massachusetts Income Tax H R Block

Dor Tax Bills Collections Audits And Appeals Mass Gov

Massachusetts State 2022 Taxes Forbes Advisor

Crypto Mass Adoption A Matter Of When Not If Nasdaq

Upload An Excel Spreadsheet And Make A Payment For Paid Family And Medical Leave Mass Gov

Thai King Maha Vajiralongkorn Under Political And Tax Scrutiny In Germany Asia An In Depth Look At News From Across The Continent Dw 14 02 2022

Massachusetts State Tax Software Preparation And E File On Freetaxusa